Corn:

On Monday, corn on exchanges in the United States was neutral, but in Europe there was bearish pressure. As a result, the December corn futures did not change their prices at CBOT in Chicago at the end of daily trading, while the November futures on Euronext in Paris fell by 1.75 euros per ton or by 0.70%.

Weekly harvest progress data released in the NASS Crop Progress report showed that as of Oct. 24, U.S. farmers had harvested 66% of the corn crop, in line with previous trade expectations. The current rate of harvest in the United States is ahead of the average annual rate by almost a week. On average, over the past 5 years, as of this date, the corn crop in the country was harvested from 53% of the fields. Rains are forecasted in the eastern corn belt areas in the coming days, which could slow down the country’s harvesting process.

Let me remind you that in Ukraine as of the end of last week, 32.2% of the corn crop or 11.155 million tons were harvested.

It is also worth remembering that there is some concern among analysts about the quality of corn in northern China due to heavy rains. Recently, central Brazil has also had strong winds, rains and hail, which could have a negative impact on future harvests.

The USDA in its report Export Inspections reported that during the week that ended October 21, 545,127 thousand tons of American corn were shipped for export. Current volumes were significantly lower than the corresponding figure of the previous week, which amounted to 1.05 million, and for 680 thousand tons that were shipped for export during the same week last season. Total accumulated U.S. corn exports since the beginning of 2021/22 MY reached 4.713 million tons (185.5 million bushels), still 57 million bushels behind last season’s corresponding pace, when 6.17 million tons were exported.

As already reported, according to the State Customs Service of Ukraine, as of October 25, 385 thousand tons of Ukrainian corn were exported since the beginning of the month, and since July 1 of this year, this figure has increased to 1.815 million tons. The volumes of current corn exports are ahead of last year’s corresponding figures by 278 thousand tons.

Soy:

On Monday, the soybean and soybean meal markets in the United States again reversed their directions. Thus, at CBOT, the cost of November soybean futures at the end of daily trading increased by $6.18 per ton or 1.38%, while the price of December futures for soybean meal decreased by $0.22 per ton or 0.06%.

The U.S. Department of Agriculture in its weekly crop Progress report reported that as of October 24, the soybean crop was harvested from 73% of the acreage. This is 13% more than a week earlier, and remains 3% above the average annual rate. Let me remind you that on the eve of the USDA report, traders expected that the NASS would show the level of soybean harvesting in the US in the range from 75% to 76% of the cultivated area.

Current soybean sowing conditions in Brazil remain favorable so far, making the 2022 harvest for the record. According to AgRural, as of October 21, Brazilian farmers sowed soybeans on 38% of the projected acreage for this crop against 22% a week earlier and 23% on the same date last year. The current rate of sowing is the fastest on record.

According to Export Inspections, during the week ended October 21, 2.1 million tons of American soybeans were shipped for export against 2.45 million a week earlier and 2.89 million during the same week last year. The USDA also added 152,859 thousand tons of beans in its previous reports, bringing total exports since the beginning of the current marketing year to 8.129 million tons against 14.78 million on the same date last year.

According to official information of the Ministry of Agrarian Policy and Food of Ukraine as of October 25, sown areas under winter rapeseed in the country for the harvest of 2022/23 MY increased to 1.008 million hectares and amounted to 98% of the forecast.

Wheat:

Yesterday on the stock exchanges in the United States, wheat maintained upward price trends. Thus, the cost of December futures for SRW wheat on CBOT in Chicago at the end of Monday’s trading increased by $1.25 per ton of grain or by 0.45%, and at HRW wheat in Kansas – by $1.32 per ton or by 0.46%.

According to the Crop Progress report, as of October 24, winter wheat crops in the United States rose to 80% of the current year’s planned crops. The weekly progress was 10%. The NASS also reported that as of the end of last week, seedlings were received at 55% of crops against 60% at the same date last year. Also, as of October 24, according to the NASS, the condition of winter wheat crops is estimated as 46% good and excellent, which corresponds to 325 on the Brugler500 index. This is better for the corresponding last year’s figure on the same date, which was 41% or 322 on the Brugler500 index.

The USDA in its report Export Inspections said that during the week that ended October 21, 140,413 thousand tons of US wheat were shipped for export, which was comparable to 141,450 thousand tons of exports a week earlier, but less than 399,645 thousand tons shipped during the same week last year. The USDA’s weekly report showed that the total accumulated wheat supply since the beginning of 2021/22 MY across the US rose to 9.478 million tons, but they are still 17% inferior to the corresponding last year’s figure.

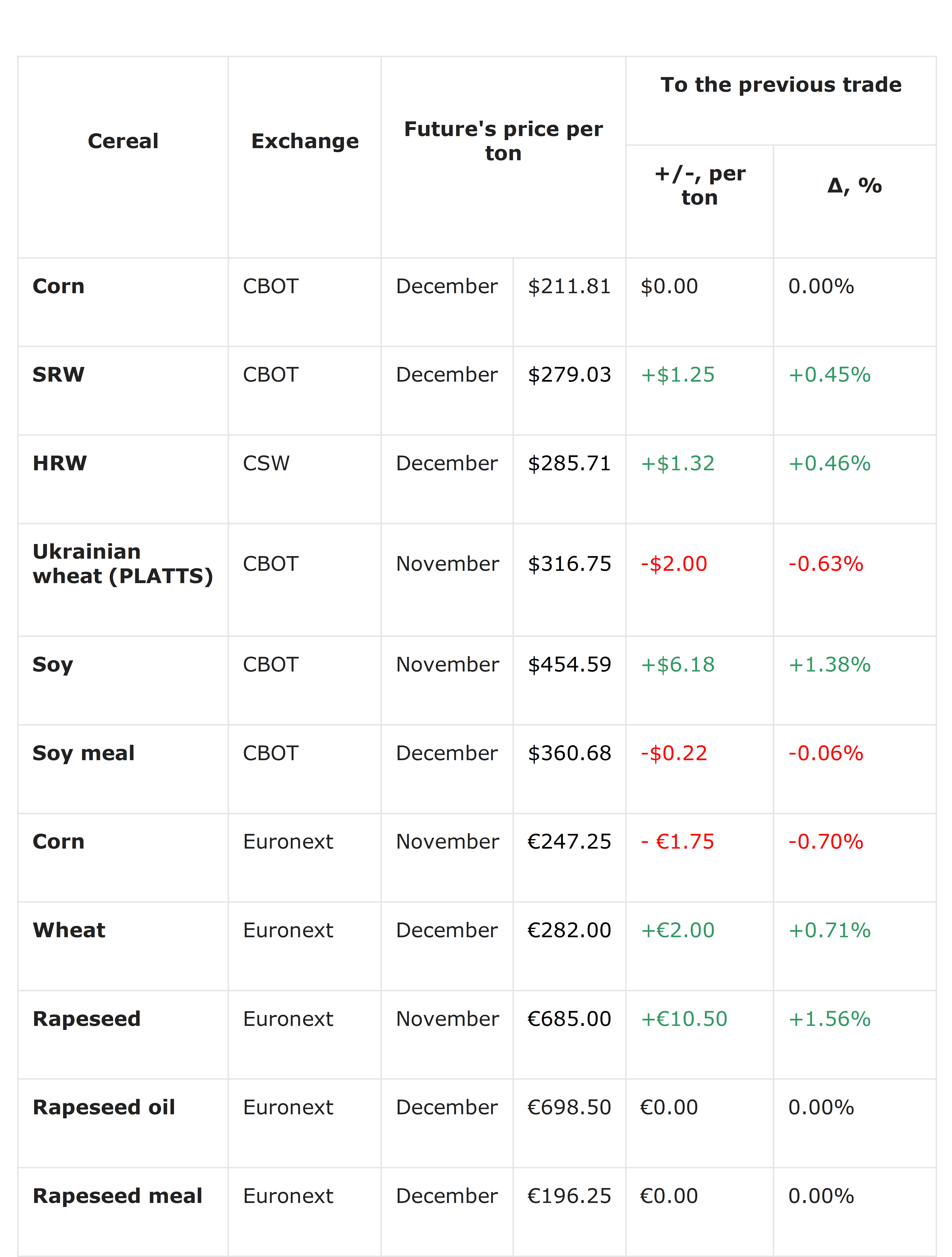

Exchange prices for the main grains and oilseeds on the CBOT, KCBOT and Euronext exchanges:

P.S. All prices in chicago (CBOT) and Kansas City (KCBOT) are converted to USD per metric ton.